What’s a truck loan calculator?

A truck loan calculator is a simple online tool that computes your estimated loan repayments. It calculates your repayments according to the loan amount, interest rate, and loan term you provide. You can approximate your loan repayments for different loan terms, varying repayment frequencies, and a range of interest rates.

This truck finance calculator is great for comparing your loan options or as a frame of reference. Take note, this calculator only provides a repayment estimate based on the information given. Use the results of the calculator to guide you when searching for the right truck loan.

How to use the truck loan calculator

Using a truck loan calculator is pretty straightforward. Follow these steps and get a truck loan repayment estimate instantly.

Step 1: Enter the loan amount

The loan amount is the total cost of the truck minus any down payment you plan to make. Down payments aren’t essential for vehicle loans, but they could help lower your regular repayments.

Step 2: Enter the vehicle purchase price

Put the purchase price of the truck you want to buy. If you’re unsure about the final purchase price, it’s best to put the higher-end price to be on the safe side. You can always change the price later and get a new repayment estimate.

Step 3: Choose a loan term

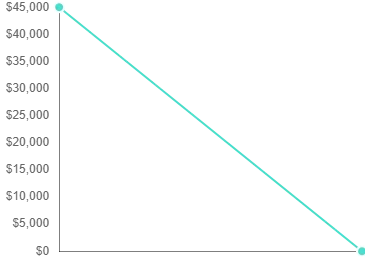

The loan term is the length of time you’ll be making payments on the loan. The truck repayment calculator gives you three options for the loan term: 5 years, 4 years, or 3 years. See how the loan term affects your regular repayments.

Step 4: Input the interest rate

The interest rate is what you’re charged in addition to the principal loan amount. The rate changes depending on market factors, your credit score, and the type of loan you’re getting. Talk to one of our expert brokers to discuss the interest rates on your loan.

Step 5: Add a balloon payment amount

A balloon payment is an amount owed at the end of the loan term. You’ll pay it off as a lump sum after you’ve made all your repayments. Borrowers choose to add a balloon payment to their loan to lower their regular loan repayments.

Step 6: Pick a loan repayment frequency

The loan repayment frequency indicates how often you plan to pay off your loan. Choose from weekly, fortnightly, or monthly on the calculator. Learn how your regular repayments differ when you change repayment frequencies.

Why should you use a truck repayment calculator?

A truck loan calculator helps you save time and money while helping you understand your truck finance options better. No need to compute everything yourself—simply input the information and you’re good to go. Plus, you can quickly narrow down your truck search to models that fit your budget.

The truck loan repayment calculator gives you an idea of what your regular payments will look like so you can plan your finances accordingly. You'll be able to see if changing loan terms or repayment frequencies can save you money on the lifetime of the loan.

Tips when using a truck loan calculator

When using a truck loan calculator, keep in mind that the estimated payment may not be exact. Your actual payment will depend on your agreement with the lender once your loan application has been approved.

Before you make any final decisions, factor in additional expenses such as insurance and maintenance costs when budgeting for your new truck.

To get the most out of the truck finance calculator, compare loan options from multiple lenders. This gives you a better idea of the going rate for truck loans in the market. You’ll make a better-informed decision once you’ve done your research and compared truck loans.

Choosing the right truck loan for you

To get the best truck loan, keep these helpful tips in mind:

-

Consider repayment frequency – Choosing a weekly or fortnightly loan repayment could save you in the long term. More frequent payments could mean paying less interest over the lifetime of the loan.

-

Think about the loan term – Longer repayment terms may result in lower monthly payments, but you'll end up paying more in interest over the life of the loan. The opposite is true for shorter repayment terms.

-

Look at the hidden costs – Before signing any loan agreement, make sure to read the fine print. Look for any hidden fees or charges, and make sure you understand the terms and conditions of the loan.

-

Research different lenders – Do your research to find out which lenders offer the best rates and terms for truck loans. Look at interest rates, repayment terms, and fees to determine which lender is the best fit for you.

Find the best truck loan with ease— Aussie Truck Loans is here to help!

Searching for the right truck loan can be overwhelming. The good news is there’s a way to streamline the process. With Aussie Truck Loans, you don’t have to look through dozens of different lenders and finance options. We’ll do that for you!

Aussie Truck Loans can provide a truck loan that’s catered to your needs. Powered by carloans.com.au , our expert brokers are here to find the best truck loans for you. Contact us now to get started or get a quick quote online.